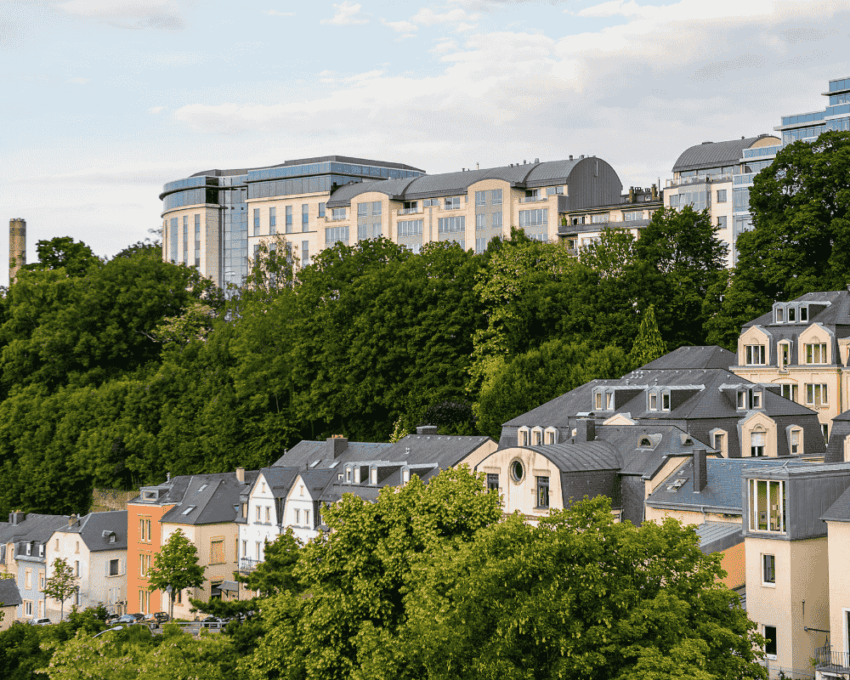

Interest Rates in Luxembourg: A Positive Trend for Homebuyers

Good news for future homeowners: interest rates in Luxembourg have been steadily declining for several months. This trend is closely linked to decisions by the European Central Bank, which has lowered its key rates eight times in a row since June 2024.

Mortgage rates for housing loans have become more attractive. According to the latest data from the Central Bank of Luxembourg, fixed one-year rates have dropped to 3.5 percent, the lowest level since March 2023. For longer-term loans, rates are now around 3.45 percent.

This creates a more favorable environment for property purchases. Borrowing conditions are more accessible, encouraging many households to take the leap into homeownership. Young families in particular are opting for long-term loans ranging from 25 to 35 years, reflecting a growing confidence in long-term commitments.

Experts anticipate only a modest additional decrease in rates by the end of the year, possibly around 25 basis points. This means current conditions are likely among the most advantageous in the near term.

Tax Incentives Ending on June 30, 2025

It is also important to keep in mind that certain tax benefits, such as the housing tax credit, will end in June 2025. After this deadline, the evolution of property prices will play an even greater role in buying decisions.

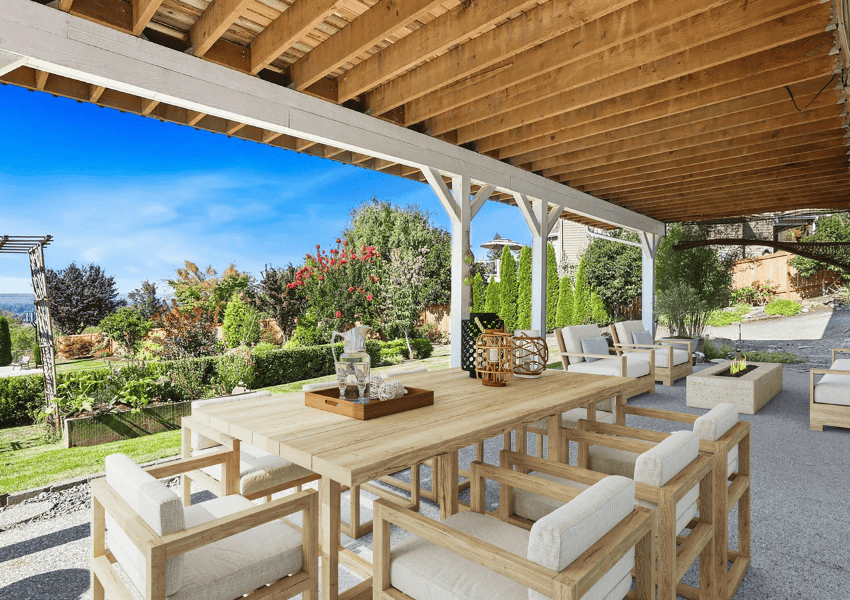

Are You Planning to Buy a Property?

This may be the right time to take advantage of lower interest rates and secure your project. Reach out to our RE/MAX Sweet Home team for personalized support and guidance tailored to your needs.